Last week, I added a new FTSE 100 stock to my portfolio. It wasn’t Lloyds, BP, GSK, or another highly popular stock that every investor seems to own. Instead, it was an under-the-radar Footsie stock that has been one of the best performers on the London Stock Exchange over the last decade.

Interested to know what stock I bought? Read on and I’ll tell you.

A FTSE 100 star

The stock I bought for my portfolio was Ashtead (LSE: AHT), an international equipment rental company that operates in the US, the UK, and Canada. Trading under the name Sunbelt Rentals, it hires out a full range of construction and industrial equipment to a diverse customer base.

Should you invest £1,000 in Diageo right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Diageo made the list?

Currently, Ashtead is the second largest equipment rental group in North America with around 1,025 stores and nearly 18,000 employees. The US accounts for over 80% of total group revenues. In the UK, it’s also the largest equipment rental group with 184 stores.

Over the long term, AHT shares have been a great investment. Indeed, over the last decade, the FTSE 100 stock has been a ’10 bagger’ for investors.

Why I invested

As for why I bought Ashtead shares, the main reason is that I expect the company to benefit from supply chain onshoring in the US.

Right now, the US is undergoing a huge reshoring initiative to boost domestic production and eliminate supply chain vulnerabilities. Earlier this month, for example, it was announced that Taiwan Semiconductor is set to build another chip manufacturing plant in Arizona.

This kind of activity should provide huge tailwinds for Ashtead as its construction equipment – which can be used to dig, drill, lift, move, power, etc – is likely to be in high demand.

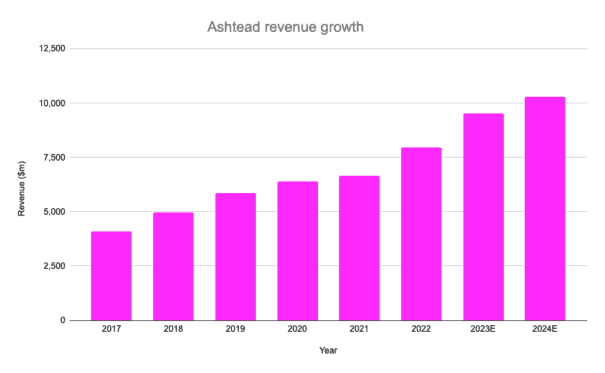

It’s worth noting that Ashtead already has a lot of momentum. For the half-year to 31 October, the group reported revenue growth of 26% and adjusted earnings per share growth of 32%.

On the back of these results, the group raised its guidance for the full year. It also lifted its dividend payout by 20%.

“Our business is performing well with clear momentum in robust end markets,” said CEO Brendan Horgan.

I thought these results were very encouraging, especially the 20% dividend increase.

Valuation

Another reason I snapped up stock is that the valuation seems very reasonable to me. Currently, analysts expect Ashtead to generate earnings per share of $3.72 for the year ending 30 April 2023. At the current share price and exchange rate, that equates to a forward-looking P/E ratio of about 16.6.

I see value at that multiple, given the growth the company is generating right now and the long-term growth story associated with US reshoring.

Risk/reward

As for the risks here, there are a few I’m monitoring closely. One is debt on the balance sheet. In recent years, Ashtead’s debt has risen on the back of acquisitions. At 31 October, net debt was $8.4bn. This could create challenges if interest rates continue rising.

Another is the state of the US economy. If this was to fall into a deep recession and construction came to a near-halt, Ashtead could suffer.

Overall, however, I see a lot of appeal in Ashtead shares right now. So I bought a few for my portfolio.